Short-term care insurance vs long-term care is a critical topic for anyone considering their future healthcare needs. As life expectancy increases, the necessity for appropriate care solutions becomes ever more pressing. Both options offer distinct advantages and considerations, making it essential to thoroughly understand each before making a decision.

Short-term care insurance typically provides coverage for a limited period, making it ideal for temporary recovery situations, while long-term care focuses on extended assistance for chronic illnesses or disabilities. Understanding the nuances of these options and their financial implications can significantly influence one’s approach to healthcare planning.

Comparison of Short-term Care Insurance and Long-term Care

Short-term care insurance and long-term care options provide essential support for individuals facing health-related challenges, but they cater to different needs and circumstances. Understanding the nuances between these two types of care can significantly impact the quality and affordability of care when it’s needed most.Short-term care insurance typically covers a limited duration of care, often up to six months, while long-term care encompasses services that may last for years or even a lifetime.

This distinction is crucial when assessing which option better fits an individual’s needs and financial situation. The benefits and limitations of each insurance type can affect not only the care received but also the overall financial impact on the policyholder.

Benefits and Limitations of Coverage

When evaluating short-term care insurance against long-term care options, it’s helpful to look closely at the specific benefits and limitations associated with each type. Here are key points to consider:

- Short-term Care Insurance:

- Provides immediate access to care for a defined period, which can be beneficial for recovery from surgery or a serious illness.

- Generally has lower premiums compared to long-term care insurance, making it more accessible for those who may not need extended care.

- May cover in-home care, rehabilitation, or care in skilled nursing facilities, depending on the policy.

- Long-term Care:

- Offers comprehensive coverage for an extended duration, ideal for chronic conditions or disabilities requiring ongoing assistance.

- Includes various services such as personal care, skilled nursing, and custodial care in diverse settings like nursing homes or assisted living facilities.

- Can be more expensive due to the extended coverage, but it provides peace of mind for those concerned about long-term health issues.

Situations Favoring Short-term Care Insurance

Short-term care insurance can be particularly advantageous in specific scenarios where immediate, temporary care is necessary. Here are some situations where this type of insurance may be more beneficial:

- After a major surgery, where a short recovery period is expected and temporary care is needed to assist with daily activities.

- In cases of sudden illness or injury where the individual has a solid prognosis and is likely to return to independent living soon.

- For individuals who have significant savings or other financial resources that can cover short-term care costs, making the lower premium attractive.

Financial Implications of Premiums and Coverage

The financial aspect of choosing between short-term and long-term care insurance involves a variety of considerations. Understanding how premiums and coverage affect overall costs is critical for decision-making.

The average cost of long-term care insurance premiums can range significantly based on age, health status, and benefit amounts, often falling between $2,000 and $3,000 annually for someone in their 50s.

Factors influencing the decision may include:

- Short-term care insurance typically has lower premiums, making it an appealing alternative for those who anticipate short-lived care needs.

- Long-term care insurance, while more costly, can offer substantial financial protection against exhausting savings due to prolonged care expenses.

- Choosing between the two requires evaluating personal health status, family medical history, and the potential need for future care to align financial resources with expected needs.

Understanding Long Term Care Services

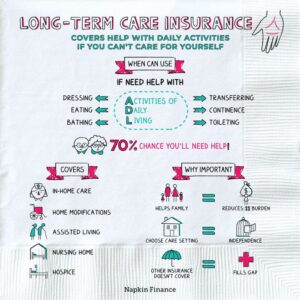

Long-term care services encompass a variety of support options designed to assist individuals who need help with daily activities over an extended period. As people age or face chronic illnesses, the need for such services can become increasingly important. Understanding these services, their benefits, and how they are funded is essential for effective planning and ensuring that individuals receive the care they require.Long-term care services can be categorized into several types, each offering distinct benefits tailored to individual needs.

These services range from in-home care to facility-based options, providing flexibility and choice for those requiring assistance.

Types of Long-Term Care Services

There are several types of long-term care services available, each designed to meet different needs. Below is an overview of the most common types:

- In-Home Care: This service allows individuals to receive personal care and assistance in the comfort of their own homes. Caregivers can help with daily tasks such as bathing, dressing, and meal preparation, making it a preferred option for many.

- Assisted Living Facilities: These environments provide residents with their own living spaces while offering support for daily activities. This option fosters independence while ensuring that help is readily available when needed.

- Nursing Homes: For individuals requiring more comprehensive medical care, nursing homes offer 24-hour supervision and medical support. This option is ideal for those with severe health conditions or disabilities.

- Memory Care Units: Specialized facilities designed for individuals with Alzheimer’s disease or other forms of dementia. These units provide structured environments and skilled staff trained to handle the unique challenges associated with memory loss.

The funding of long-term care is a critical aspect that individuals should consider in their planning. There are multiple avenues available to finance long-term care, including both public and private options.

Funding for Long-Term Care

Understanding how long-term care is funded can help individuals make informed decisions. The primary funding sources include:

- Medicare: This federal program covers short-term skilled nursing care and some home health services, but does not typically pay for extended long-term care.

- Medicaid: A state and federal program that provides assistance for low-income individuals. Medicaid can cover a significant portion of long-term care costs, but eligibility requirements vary by state.

- Long-Term Care Insurance: This private insurance product helps cover the costs associated with long-term care. Policies vary widely in terms of coverage and conditions, making it crucial to shop around.

- Personal Savings: Many individuals use their savings to pay for long-term care. However, this can deplete resources quickly, making financial planning essential.

Planning for long-term care is vital to avoid potential financial and emotional burdens. Failing to prepare can lead to significant challenges for individuals and their families, including:

Consequences of Unpreparedness

Without proper planning, individuals may face overwhelming costs that can deplete savings and lead to financial strain. The implications of being unprepared for long-term care include:

- Increased Financial Burden: Unprepared individuals may find themselves relying on emergency funds or accumulating debt.

- Limited Care Options: Without prior planning, the range of care options may be restricted, forcing families into less desirable situations.

- Emotional Stress: The lack of a care plan can lead to emotional distress for both the individual and their family members, affecting overall well-being.

“Proper planning for long-term care is not just a financial decision; it’s an investment in peace of mind for you and your loved ones.”

Decision-Making Factors for Care Insurance

Deciding between short-term and long-term care insurance is a significant choice that can greatly impact one’s financial stability and quality of care in the future. Understanding various factors can help individuals navigate this decision more effectively, ensuring that their unique needs and preferences are met.When evaluating care insurance options, several key factors should be considered. These include the duration of care one may require, anticipated health conditions, financial implications, and the availability of care services.

Additionally, individuals should assess their current health status and potential future needs. This comprehensive understanding can guide them toward making an informed decision that aligns with their personal circumstances.

Key Factors for Choosing Care Insurance

Understanding the decision-making factors is crucial in selecting the appropriate care insurance. Here’s a checklist of essential points to consider:

- Duration of Care Needs: Evaluate whether short-term care suffices or if long-term coverage is necessary based on potential health issues.

- Health Status: Analyze current health conditions and family medical history to predict future care needs.

- Financial Situation: Consider current savings, income, and expense forecasts to determine how much one can afford to spend on insurance premiums.

- Type of Care Required: Reflect on whether in-home care, assisted living, or skilled nursing facilities are preferred.

- Policy Flexibility: Investigate whether policies allow for adjustments as personal needs evolve over time.

To further assist in evaluating personal care needs and preferences, individuals can use the following checklist of questions to guide their assessment:

- What is my current health status, and how might it change in the future?

- What kind of care do I envision needing—short-term or long-term?

- How much can I realistically afford to pay for insurance premiums?

- What are the specific features I want in a policy, such as benefits, coverage limits, and waiting periods?

- How do my family dynamics influence my care preferences and needs?

Case Studies Illustrating Care Needs

Real-life scenarios can shed light on how different choices in care insurance impact outcomes. The following case studies illustrate various situations:

Case Study 1: Sarah, a 65-year-old retiree, opted for short-term care insurance after a minor surgery. Her insurance covered rehabilitation services, allowing her to recover at home without financial strain.

Case Study 2: John and Mary, both in their 70s, chose long-term care insurance due to a family history of dementia. By planning ahead, they secured comprehensive coverage, which provided peace of mind and access to quality care when John developed Alzheimer’s disease.

Case Study 3: Tom, a 58-year-old with chronic health issues, initially chose short-term care insurance, believing he would manage his condition. However, as his health declined, he faced significant out-of-pocket expenses for care that could have been mitigated with long-term coverage.

These case studies highlight the importance of considering individual health needs, financial realities, and potential future scenarios when making decisions about care insurance.

Final Conclusion

In conclusion, the decision between short-term care insurance and long-term care hinges on individual circumstances, preferences, and financial considerations. By evaluating the benefits and limitations of each and considering personal care needs, individuals can make informed choices that best suit their future needs. Ultimately, proactive planning is vital to ensure peace of mind and optimal care when it matters most.

Question & Answer Hub

What is the main difference between short-term and long-term care insurance?

Short-term care insurance covers temporary care needs for a limited time, while long-term care insurance provides ongoing support for chronic conditions or disabilities.

When should I consider getting short-term care insurance?

If you anticipate needing temporary assistance after surgery or a medical event, short-term care insurance may be beneficial.

What types of services are covered under long-term care insurance?

Long-term care insurance typically covers services such as nursing home care, assisted living, and in-home care.

How are long-term care services usually funded?

Long-term care can be funded through private insurance, personal savings, Medicaid, or other government programs.

Is it too late to purchase insurance if I’m already in my later years?

While it may be more challenging to secure coverage later in life, some options may still be available; it’s best to consult with an insurance advisor.