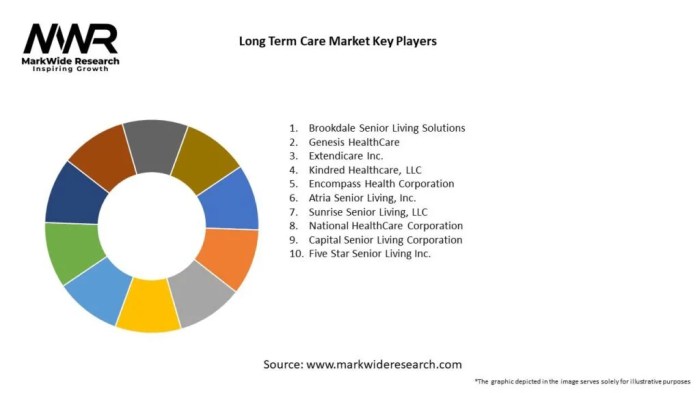

Top long-term care providers 2025 highlights the pivotal role of long-term care in our...

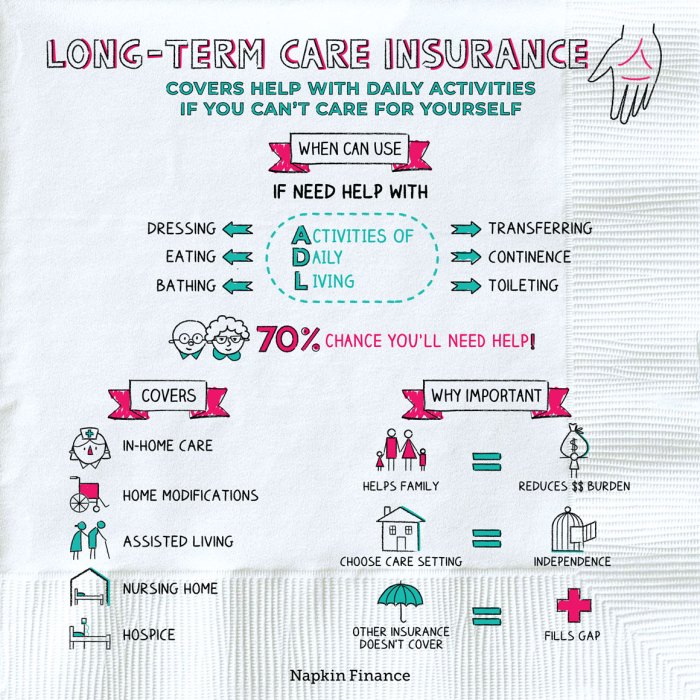

Short-term care insurance vs long-term care is a critical topic for anyone considering their...

Private pay vs Medicaid long-term care takes center stage as individuals and families face...

Long-term care insurance premiums rising has become a pressing issue for many individuals and...

Government programs for long-term care play a crucial role in ensuring that individuals receive...

Long-term care for Alzheimer’s patients is not just a necessity; it’s a vital lifeline...

Alternatives to long-term care insurance opens the door to a broad spectrum of options...