Long-term care insurance premiums rising has become a pressing issue for many individuals and families as they navigate the complexities of preparing for future care needs. Understanding the factors driving up these costs can help consumers make informed decisions about their financial planning. With historical trends showing a steady increase in premiums, it’s essential to grasp how these changes influence various demographics across different regions.

Moreover, as people live longer, the demand for long-term care services is anticipated to grow, further impacting insurance prices. Evaluating coverage options and budgeting effectively are crucial steps in managing these rising premiums, allowing consumers to secure the necessary care without compromising their financial stability.

Understanding Long-term Care Insurance Premiums

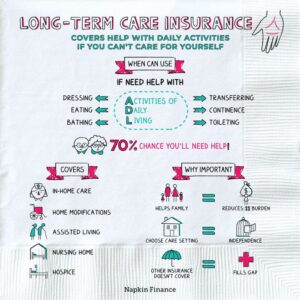

Long-term care insurance is becoming increasingly important as people live longer and require more support in their later years. However, understanding the premiums associated with such insurance can be challenging. Several factors contribute to the rising costs, and by exploring these elements, we can gain insight into the pricing trends in various regions.The increase in long-term care insurance premiums is attributed to several critical factors.

Firstly, the aging population is leading to greater demand for long-term care services, resulting in higher costs for insurance companies. Secondly, advancements in healthcare have improved life expectancy, meaning more individuals require long-term care for extended periods. Additionally, insurers are adjusting premiums to cover the rising costs of care services and to mitigate their risks. This has created a ripple effect in the pricing of policies across the board.

Historical Trends in Long-term Care Insurance Pricing

Understanding historical trends in long-term care insurance pricing reveals significant changes over the past few decades. Initially, premiums were relatively stable, but as the demand for care services has risen, costs have fluctuated more dramatically. Key trends include:

- In the 1990s, premiums were lower due to less awareness of long-term care needs and a smaller aging population.

- By the early 2000s, insurers began to raise premiums more frequently, prompted by increasing claims and healthcare costs.

- Recent data shows that many policyholders are experiencing premium increases of 10-20% or more, reflecting the need for insurers to remain solvent.

The shift toward higher premiums is a response to the stark realities of longevity and the associated costs. As more people rely on long-term care, premiums have adjusted accordingly to maintain financial viability for insurance providers.

Premium Costs Across Different States

Comparing premium costs across different states or regions highlights the disparities in long-term care insurance pricing. These variations can be influenced by local healthcare costs, state regulations, and population demographics.Factors contributing to regional differences include:

- States with a higher cost of living often have more expensive long-term care insurance premiums.

- States that have implemented stricter regulations on insurers may see higher premiums due to compliance costs.

- Demographics play a crucial role; states with a larger elderly population are likely to have higher premiums because of anticipated demand.

For example, a 55-year-old in New York could pay significantly more for long-term care insurance compared to someone in a state like Idaho, where the cost of care is generally lower. Understanding these regional variations can help individuals make informed decisions when considering long-term care insurance options.

Financial Planning for Long-term Care Insurance

Planning for long-term care insurance is essential for securing your financial future. With premiums on the rise, understanding how to budget and manage these costs becomes increasingly important. A proactive approach to financial planning not only ensures that you are prepared for potential future care needs but also helps to mitigate the impact of rising insurance costs on your overall financial health.Proper financial planning involves various strategies for budgeting effectively and managing long-term care insurance premiums.

It’s vital for policyholders to evaluate and adjust their coverage as their health care needs evolve over time. This ensures that the coverage remains relevant and adequate, preventing any unexpected out-of-pocket expenses during critical times.

Strategies for Budgeting and Managing Premiums

Effective financial strategies can help you manage long-term care insurance premiums without compromising your overall budget. Here are some key strategies to consider:

- Review Your Policy Annually: Regularly assess your insurance coverage to ensure it matches your current health status and financial situation.

- Increase Deductibles: Opting for higher deductibles can lower your monthly premiums, but ensure that you can afford the out-of-pocket costs if they arise.

- Consider Inflation Protection: Adding inflation protection to your policy can help cover future costs without a significant increase in premiums today.

- Take Advantage of Discounts: Check for any available discounts, such as those for healthy lifestyle choices or bundling policies.

Adjusting coverage is crucial as your needs change. For instance, if you anticipate needing more extensive care in the near future, upgrading your policy could be beneficial. Additionally, discussing your evolving needs with an insurance advisor can lead to tailored suggestions for your situation.

Importance of Evaluating and Adjusting Coverage

As life circumstances change, so do the requirements for long-term care insurance. Regular evaluation ensures that you stay adequately covered. Factors such as changes in health status, family dynamics, or financial situations can all necessitate adjustments to your policy.

“Failing to adapt your long-term care insurance coverage can lead to significant financial strain during critical times.”

Financial Resources and Assistance Programs

Understanding the financial landscape surrounding long-term care is essential for effective planning. There are numerous resources and assistance programs available that can help alleviate the costs associated with long-term care insurance:

- Medicaid: This government program provides coverage for long-term care services for eligible individuals, based on income and asset limits.

- Veterans Benefits: Veterans and their families may qualify for benefits that cover long-term care services.

- State Assistance Programs: Many states offer programs designed to help residents with the costs of long-term care through various grants or funds.

- Tax Deductions: Premiums for long-term care insurance may qualify for tax deductions under certain conditions, providing potential savings.

Utilizing these resources can significantly ease the burden of long-term care costs, allowing individuals and families to focus more on care and less on financial strain.

The Impact of Rising Premiums on Consumers

As long-term care insurance premiums continue to rise, the financial landscape for consumers is shifting. Many individuals and families are finding themselves at a crossroads where their options for securing future care are becoming increasingly limited. This reality prompts a reevaluation of their planning strategies, impacting both their immediate finances and long-term security.Rising premiums can alter consumer choices in substantial ways.

For many, the increase in costs leads to a reconsideration of purchasing long-term care insurance entirely. As premiums become less affordable, consumers may opt to delay purchasing coverage or may even choose to forego it altogether. This decision can leave individuals vulnerable to high out-of-pocket expenses in the event that they require long-term care. Additionally, those who currently hold policies may face the dilemma of whether to continue paying for coverage or to reduce their benefits, thereby impacting their future care options.

Alternatives to Traditional Long-term Care Insurance

In light of the rising costs associated with traditional long-term care insurance, many consumers are exploring viable alternatives. These alternatives can provide necessary coverage while alleviating the financial burden of increasing premiums. Some options include:

- Hybrid Insurance Products: Combining life insurance with long-term care benefits, these products allow for flexibility and can potentially pay out a death benefit if long-term care is not needed.

- Health Savings Accounts (HSAs): Using HSAs to save for future long-term care expenses can provide tax advantages, making it easier to set aside funds for later use.

- Short-term Care Insurance: This type of insurance can cover a limited period of care, typically providing a more affordable option for individuals who may not need long-term services.

- Long-term Care Annuities: These financial products can offer a stream of income specifically for long-term care needs, ensuring that funds are available when necessary.

The exploration of these alternatives can empower consumers to navigate the challenges posed by rising premiums while still prioritizing their long-term care needs.

Testimonials and Case Studies

Real-life experiences can shed light on the impact of rising long-term care insurance premiums and how individuals have adapted. For instance, Jane, a 62-year-old retiree, found her premiums increased by 30% in just two years. Faced with the possibility of dropping her policy, she opted to switch to a hybrid insurance product that allowed her to retain a death benefit while still having access to long-term care funds if needed.

This decision not only eased her financial burden but also provided peace of mind for her family.Similarly, John, a 70-year-old veteran, chose to utilize his Health Savings Account to prepare for potential long-term care expenses. By saving aggressively over the years, he has positioned himself to manage future costs without the stress of rising premiums affecting his quality of life.These testimonials highlight the importance of proactive planning and the availability of alternative solutions that can help consumers navigate the financial pressures resulting from rising long-term care insurance premiums.

Ultimate Conclusion

In summary, Long-term care insurance premiums are on the rise, which is reshaping the landscape of financial planning for many. As consumers seek alternatives and adjust their coverage, it’s vital to stay informed about the evolving market and available resources. By understanding the implications of these rising costs, individuals can better navigate their options and ensure they are prepared for whatever the future holds.

Essential Questionnaire

What are the main factors contributing to rising premiums?

The main factors include increased longevity, higher healthcare costs, and a growing demand for long-term care services.

How often do long-term care insurance premiums increase?

Premium increases can vary by provider but often occur annually or biannually based on underwriting assessments.

Are there alternatives to traditional long-term care insurance?

Yes, some alternatives include hybrid policies that combine life insurance with long-term care benefits, as well as self-funding options.

Can I reduce my long-term care insurance premiums?

Yes, you can consider options like increasing your deductible, adjusting your coverage amount, or exploring discounts for healthy lifestyle choices.

What assistance programs are available for long-term care insurance?

Various programs exist, including Medicaid, Veterans Affairs benefits, and state-specific assistance programs that can help offset costs.