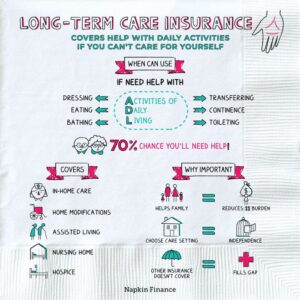

Private pay vs Medicaid long-term care takes center stage as individuals and families face the challenge of financing care for aging loved ones. Understanding the distinctions between these two options is crucial for making informed decisions about long-term care services. Whether it’s the flexibility of private pay or the financial assistance offered by Medicaid, each choice comes with its unique set of advantages and considerations.

This exploration delves into the nuances of long-term care financing, highlighting eligibility requirements for Medicaid, the costs associated with private pay, and the benefits and drawbacks inherent in each approach. By shedding light on these factors, we aim to provide clarity for those navigating the complexities of long-term care options.

Overview of Long-Term Care Financing Options

Long-term care financing is a vital aspect of ensuring that individuals can receive the support they need as they age or face health challenges. Understanding the options available can greatly influence financial planning and the type of care one might choose. This overview will highlight the differences between private pay and Medicaid for long-term care, detailing eligibility requirements and associated costs.

Differences Between Private Pay and Medicaid

Private pay and Medicaid represent two distinct pathways for funding long-term care. Private pay typically involves individuals or families directly covering the costs associated with care services, often relying on personal savings, long-term care insurance, or other financial resources. This method allows for a broader range of options in terms of facilities, services, and flexibility in care plans.In contrast, Medicaid is a government program designed to assist low-income individuals with healthcare costs, including long-term care.

It has specific eligibility criteria, including income and asset limits that must be met for individuals to qualify. Medicaid often covers less comprehensive options and may have waiting lists for services, which can limit immediate access to care.

Eligibility Requirements for Medicaid Long-Term Care

Medicaid eligibility for long-term care is determined by several factors, primarily focusing on income and asset levels. Individuals must apply through their state’s Medicaid program, which can have variations in its criteria. The general requirements include:

Income Limits

States impose strict income limits, which may vary. For instance, as of 2023, many states have a monthly income limit of around $2,523 for individuals.

Asset Limits

Most states require individuals to have fewer than $2,000 in countable assets. However, exempt assets include a primary home (up to a certain value), personal belongings, and certain retirement accounts.

Medical Necessity

A determination that the individual requires assistance with daily activities, such as bathing, dressing, or medication management, must be established through an assessment.

Costs Associated with Private Pay Long-Term Care vs. Medicaid

The financial implications of choosing private pay versus Medicaid can be significant. Private pay options tend to be more expensive, generally allowing for a wider variety of services and amenities. Here are some illustrative examples of costs:

Private Pay

Nursing homes can average around $8,000 to $10,000 per month depending on location and level of care.

Assisted living facilities may range from $3,500 to $7,000 per month.

In-home care often costs between $20 to $50 per hour. –

Medicaid

Medicaid typically reimburses nursing homes at a lower rate, averaging around $6,000 to $7,500 per month in many states.

In-home care under Medicaid may only cover specific services and typically offers fewer hours of assistance compared to private pay.

Understanding the financial implications of long-term care choices can empower families to make informed decisions about their loved ones’ care needs.

Benefits and Drawbacks of Private Pay vs Medicaid

Understanding the financial options for long-term care is crucial for individuals planning for their future needs. Private pay and Medicaid represent two distinct approaches, each with unique advantages and drawbacks that can significantly impact care decisions. This section will delve into the benefits and disadvantages of both methods to provide a clearer picture for those navigating this important choice.

Advantages of Private Pay for Long-Term Care

Private pay offers several key benefits for those seeking long-term care services. One of the primary advantages is the flexibility it provides, allowing individuals to select the type of care that best suits their preferences and needs. With private pay, families can often choose higher-quality care facilities that may offer more personalized services. Additionally, private pay often includes options for amenities and additional services that aren’t always available through Medicaid.

- Quality of Care: Private pay generally allows access to top-tier facilities and specialized services, ensuring higher standards of care.

- Customization: The ability to tailor care plans to individual needs and preferences leads to a more satisfying care experience.

- Immediate Access: Private pay can bypass lengthy waiting periods associated with Medicaid, providing immediate access to necessary services.

- Choice of Providers: Families can select their preferred care providers and facilities without being restricted by Medicaid’s network limitations.

Disadvantages of Relying on Private Pay

While private pay offers significant benefits, it comes with notable drawbacks that may deter some families from choosing this route. The most prominent disadvantage is the high cost associated with long-term care, which can quickly deplete savings and assets. Furthermore, many individuals may not be able to afford private care for an extended period, leading to financial strain.

Private pay can be financially burdensome, leading to potential depletion of savings.

- High Costs: Long-term care services can be prohibitively expensive, often exceeding $100,000 per year for skilled nursing facilities.

- Financial Risk: Families may face significant financial risks, particularly if care needs extend for many years.

- Limited Financial Assistance: Unlike Medicaid, private pay does not provide financial aid, which can make it tough for middle-class families.

- Asset Depletion: Continuous private payments can deplete assets, leaving individuals without resources for future needs.

Benefits of Medicaid Coverage

Medicaid provides critical financial assistance for long-term care, making it a vital resource for many families. One of the central benefits of Medicaid is its ability to cover a broad range of services, including nursing home care and in-home health care. This coverage can alleviate the financial burden that often accompanies long-term care.

- Financial Assistance: Medicaid helps cover the costs of long-term care for eligible individuals, significantly reducing out-of-pocket expenses.

- Comprehensive Services: Medicaid typically covers a wide array of services, including medical care, prescription drugs, and support services.

- Protection of Assets: Medicaid allows certain assets to be protected, ensuring that individuals do not lose everything to cover their care costs.

- Long-Term Coverage: Medicaid provides coverage for an extended period, which is crucial for individuals facing chronic conditions or disabilities.

Making the Right Choice for Long-Term Care

Selecting the appropriate financing option for long-term care is a significant decision that can greatly impact both financial stability and the quality of care received. Understanding the nuances between private pay and Medicaid is essential for individuals and families navigating this often complex landscape. Key factors influencing this choice can include personal financial situations, care needs, and potential future expenses.Assessing your financial situation is crucial when deciding between private pay and Medicaid.

This involves reviewing income, assets, and potential medical expenses. Below are some essential factors to consider in this assessment:

Key Factors in Decision-Making

Understanding the following factors can aid in making an informed decision regarding long-term care financing.

- Income Level: Evaluate your monthly income sources, including pensions, Social Security, and any other earnings. This will help determine your ability to afford private pay options.

- Asset Evaluation: Assess your total assets, including savings, property, and investments. Medicaid has specific asset limits that must be met to qualify for assistance.

- Care Needs: Consider the level of care required (in-home assistance, assisted living, or nursing home care). Different types of care can significantly influence costs.

- Future Planning: Anticipate future health care needs and potential changes in financial circumstances. Planning for the long term can prevent unexpected financial strains.

- Family Support: Evaluate if family members can contribute to care costs or provide care themselves, which may reduce the need for professional services.

Assessing these factors involves creating a comprehensive overview of both current and anticipated financial situations. An effective way to visualize this decision-making process is through a flow chart. This flow chart can Artikel the steps involved in determining the best financing option for long-term care based on individual circumstances.

“A clear financial overview can simplify the decision-making process for long-term care.”

Here’s a description of how the flow chart might look:

1. Start with Income Assessment

Begin with listing all sources of income.

2. Evaluate Total Assets

List and evaluate all assets to determine Medicaid eligibility.

3. Determine Care Needs

Identify the level of care required and associated costs.

4. Future Health Care Planning

Consider potential future health care needs.

5. Choose Pathway

Decide if private pay or Medicaid is more suitable based on the evaluation of all the above factors.This structured approach helps to simplify what can be a daunting decision, ensuring that all relevant financial considerations are accounted for. By clearly evaluating income, assets, and future care needs, individuals can make more informed choices regarding their long-term care financing options.

Summary

In summary, the choice between private pay and Medicaid for long-term care is not merely financial; it’s about aligning care preferences with personal circumstances. By weighing the pros and cons of each option and considering individual needs, families can make informed choices that best suit their situations. Ultimately, understanding these financing avenues empowers individuals to secure the care that is right for them or their loved ones.

Essential FAQs

What is the primary difference between private pay and Medicaid?

The primary difference lies in funding sources; private pay involves out-of-pocket expenses, while Medicaid is a government program that provides financial assistance based on eligibility criteria.

Can I use both private pay and Medicaid for long-term care?

Yes, some individuals may use private pay to cover care initially before qualifying for Medicaid, although this can vary based on state regulations.

How do I determine if I qualify for Medicaid long-term care?

Eligibility for Medicaid long-term care depends on various factors, including income, assets, and medical needs; it’s best to consult with a Medicaid specialist or your local Medicaid office.

What kind of services are covered by Medicaid for long-term care?

Medicaid typically covers a range of services, including nursing home care, personal care, and home health services, depending on the state and specific plan.

Is private pay always more expensive than Medicaid?

In many cases, private pay can be more expensive than Medicaid, especially for comprehensive services, but it can offer more flexibility and choices in care options.